Jetpac Part 2: Creating a $2M business in 1 year

- Emily Chua

- Dec 26, 2024

- 4 min read

We achieved tremendous growth within the first 3 months of launch, acquiring 10K users in the same period. With such promising results, low OPEX and CAPEX in scaling the product, we decided on taking the product global to other markets. However, before that, we had to resolve emerging issues to build up stakeholders’ confidence:

Negative product margins: Users’ data usage patterns were much higher than we anticipated.

Low NPS: Customer satisfaction was being affected by the inconsistent product quality, which needed to be resolved by vendors and partners in the backend.

Unsustainable growth: There was high churn, in part due to low satisfaction and in part due to Jetpac being a seasonal, infrequent product. This, coupled with high marketing costs in order to increase awareness at the initial launch, led to an unfavourable LTV:CAC ratio.

To safeguard product margins, we redid our cost projections with new data from the launch and iterated on the product construct and pricing in a rapid test and learn approach until we found a good balance between margins and growth.

Next, I obsessed over the customer experience, read through every customer ticket and user feedback, consolidated the top complaints and quickly found that people were

1) Unhappy with the inconsistent network quality (which was not much in our control as it involved multiple vendors on the backend),

2) Unsatisfied with the level of customer support received, and

3) Still struggling with setting up their eSIM properly during onboarding.

The tricky part was that these cases had a blend of all three. A customer could be complaining that the customer support expert was unable to resolve his network issue but upon deeper investigation, we realise that it was a step he missed in the onboarding process. While customer journey frameworks typically break the user experience down into phases, I learned that reality is usually a lot more complex and nuanced.

We created self-diagnostic network tools, built more functions that would enable the customer support team to determine and resolve customer issues, and redesign the onboarding journey based on the users’ comments from the launch.

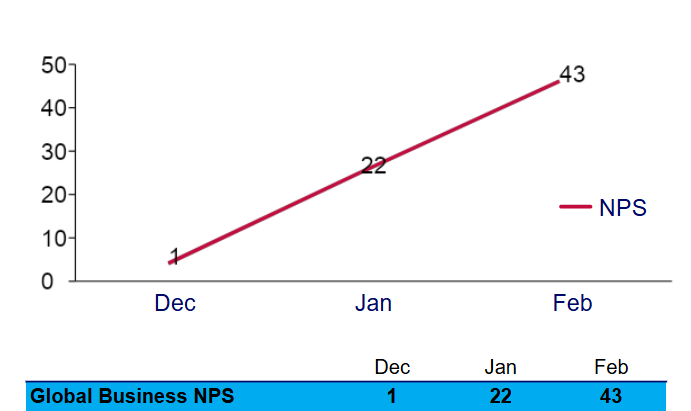

With all these initiatives in place, not only did Net Promoter Scores improve significantly, the product ratings on third-party review platforms.

Proving Product-Market Fit

However, despite the tangible improvements in satisfaction metrics, churn, used typically in a subscription business model to prove PMF, was still high. Was there a deeper issue affecting customer satisfaction?

Because travel being a seasonal activity, we should expect a lower usage frequency. A subscription in this case was not the right business model for an infrequent product. Instead, we needed to focus on ensuring that we were “retaining” the customer such that the next time they planned to travel, they would come back to make a repeated purchase.

Proving some level of PMF would need to be defined as achieving a high market penetration rate, rather than the unsubscription rate on the product. There was a lot of debate regarding the hypothetical ceiling that we could reach in the current market, as infrequent activities were hard to predict. I’ll skip over the math for this part, but essentially, collating data from multiple sources (government statistics, user surveys, and competitors’ site traffic, etc.), I was able to piece together a picture of the ROI with further investment, which made scaling to other markets an easy decision since we were already close to the market ceiling.

Going global

With some confidence of product-market fit from our stakeholders, we could begin launch in other markets. At this point, the product focus shifted to scalability and protecting vulnerabilities. This included upgrading our fraud detection systems, enabling a global payments system etc.

We also started focusing a lot more on our GTM strategy in new markets. For key markets, we analyzed top competitors and localized our product messaging. We experimented with many channels to determine which was best suited for our context, based on each one’s viability, efficiency and scalability, and then to double-down our investments on those channels.

To-date, Jetpac has users in 214 territories :)

Key Takeaways

Reality is far more complex and nuanced. Nothing beats hands-on experience and fortunately, I had guidance from stellar product leaders throughout the process.

Learning to adapt to changing circumstances (and prepping your team’s mindset for the same) was so important. We have had, on numerous occasions, long discussions about tweaks to the product whenever we discovered new market or user insights.

Keeping focused on the big picture is a lot harder when you’re also involved in the execution. It’s so easy to get lost in the details but it’s important to remind yourself (and the team) of the objective and end goal.

And lastly, having a team whom you can trust to get things done was in my experience, the biggest contributing factor to the successes we saw. The late nights, the determination to push towards the finish line was an experience that humbled me. If anything, my flaws and weaknesses were highlighted in this process, and my team was always gracious to cover my back. It created a camaraderie that was simply phenomenal.

Comments